Charles Oppenheim, the head of the United States Department of State’s Visa Control & Reporting Division, gave a talk about visa availability going into FY2021 for the EB-5 Immigrant Investor Program. Oppenheim discussed the effects of consulate shutdowns in 2020 and possible solutions to the expected congestion of EB-5 investor visas in 2021. He also spoke about the confusing puzzle of EB-5 visa wait times.

Like most investments, virtually nothing is 100% guaranteed in the EB-5 investment program. One area of uncertainty is with visa wait times, which can depend on backlogs, petition withdrawals, and visa ability, among other things. All visa wait times are estimates, but these estimations can be helpful for investors.

How Do Supply and Demand Affect EB-5 Visa Wait Times?

The filing of the I-526 petition is the first step in the journey of an EB-5 investor. The constantly fluctuating number of filed I-526 petitions also affects EB-5 visa wait times. These wait times increase when there are more eligible investors than available visas, which are limited due to yearly visa quota constraints. Thus, investors who file their I-526 earlier can be protected from an increase in demand. If many eligible investors file I-526 petitions, those who filed earlier will have a reduced wait time.

Demand Often Exceeds Supply for EB5 Investment Visas

Traditionally, only roughly 10,000 visas are allotted for the EB-5 investment program for a fiscal year from October 1 to September 30 of the following year. This number of visas is also given to eligible immigrant investors and their family members who qualify. Consequently, the number of visas issued exceeds the number of EB-5 investments. On average, USCIS received applications for two family members per EB-5 immigrant investor. This means that only around 3,300 visas are available annually for distinct EB-5 investments.

Calculations for EB-5 visa allotment are also done by country, with 7%, or roughly 700 visas, available for each country in normal fiscal years. If a country has unclaimed visas, those visas are then allotted to countries that have a higher demand than supply. Total EB-5 investment visa demand often outpaces supply, extending EB-5 visa wait times.

What Does the EB-5 Visa Bulletin Tell Us About Wait Times?

The State Department provides a Visa Bulletin every month. This bulletin shows whether countries are current (that is, visas are available) and the cut-off dates for backlogged countries where demand for EB-5 investment visas is significantly greater than the number of visas available. Applicants whose priority dates, or the dates on which USCIS received their applications, fall before their listed cut-off date are eligible to receive their EB-5 investor visas during that month. Investors who have priority dates that are earlier than their cut-off date are also able to apply for a U.S. green card.

What Is Visa Retrogression and What Does It Mean for EB-5 Investors?

As EB-5 investors receive their visas, cutoff dates usually move forward. However, sometimes cutoff dates move backward—a phenomenon known as visa retrogression. Visa retrogression often occurs near the end of the fiscal year when the number of available visas dwindles, but it can also occur if many applicants with a certain priority date submit their applications and USCIS becomes overwhelmed. Priority dates usually return to their pre-retrogression status once the new batch of visas is issued in October.

Visa retrogression typically affects a small number of countries with a high demand for the EB-5 investment program, such as Vietnam, India, and China. When the number of allotted visas has been exhausted for certain countries, investors from those countries are first in line for leftover visas from countries where supply exceeds demand at the year’s end. This further contributes to the new fiscal year resulting in a return to pre-retrogression dates.

What Goes into Calculating EB-5 Visa Wait Times?

The monthly Visa Bulletin offers insight into how EB-5 wait times work and how long EB-5 investors may have to wait. While not an exact science, investors can reliably use past wait time data to speculate about how long their application may take.

Standard Formula to Calculate EB-5 Visa Wait Times

EB-5 visa wait times are typically estimated using the following formula:

A ÷ B = C

A: Estimated number of EB-5 investment participants waiting for a visa

B: Estimated annual number of visas allotted for a country (roughly 700)

C: Expected wait time

How Does Oppenheim Use the Standard Formula to Calculate Wait Times?

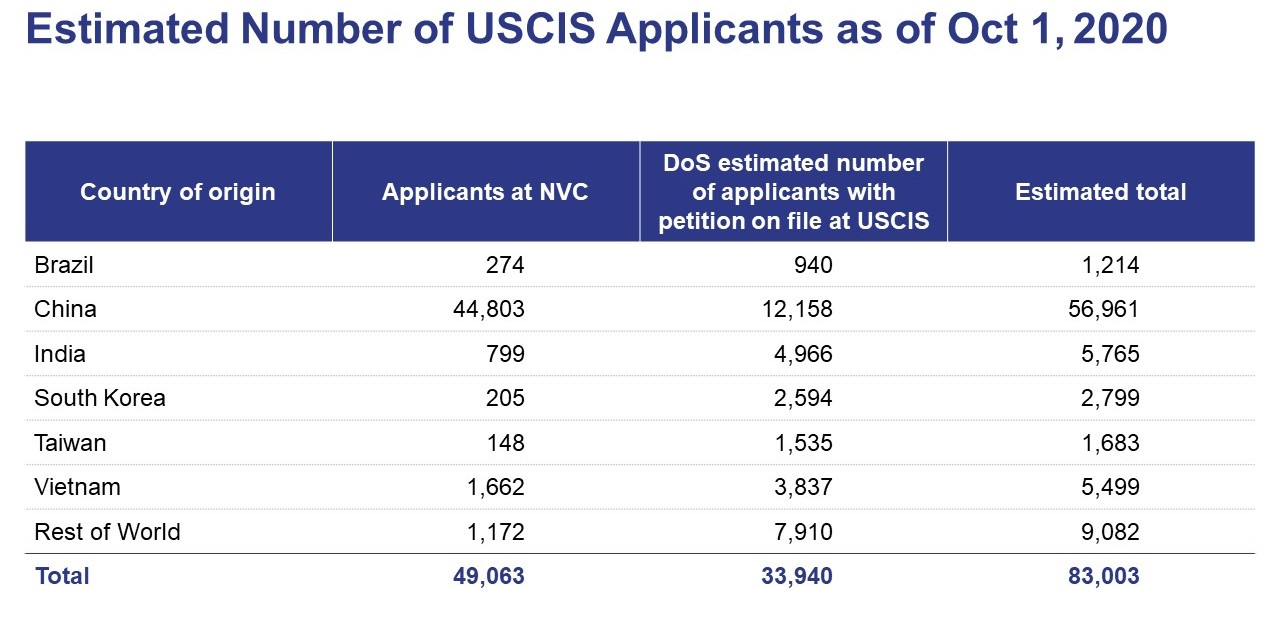

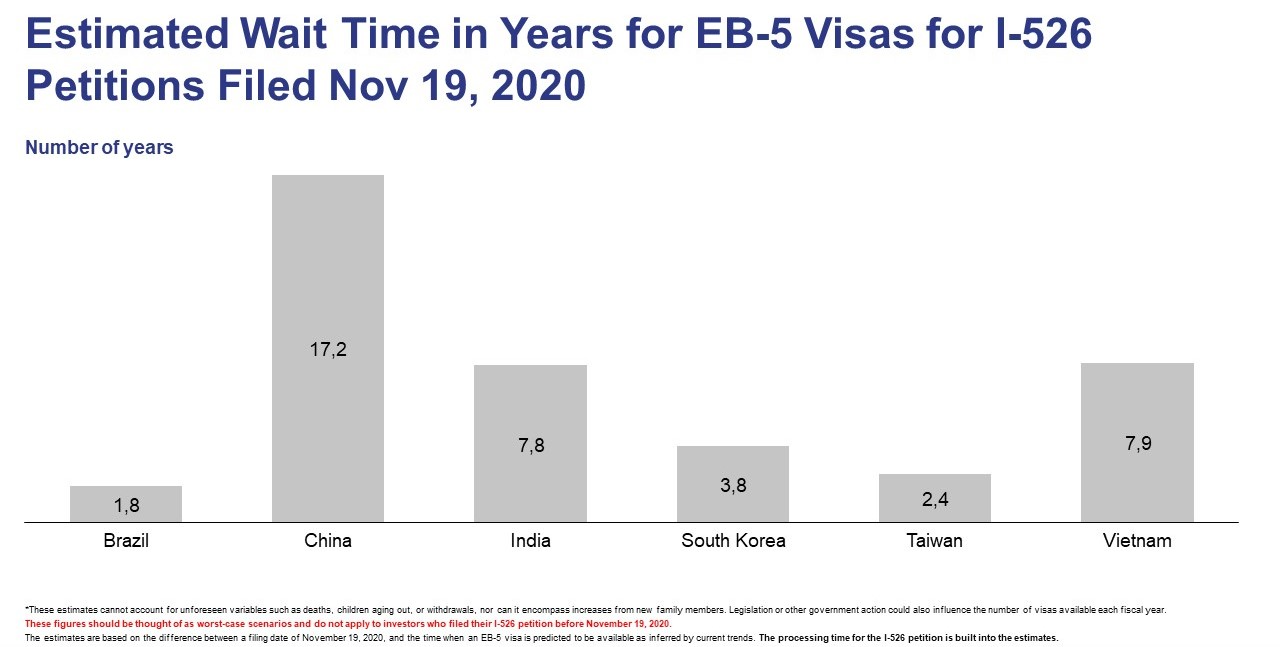

Oppenheim used the same method to calculate visa wait times in his November 2020 presentation. The first graphic’s last column (“Estimated Total) reflects variable A and the figures in the gray columns in the second graphic represent variable C. Variable B can be estimated by dividing A by C.

Oppenheim’s predictive analysis has some problems.

The Biggest Problem with How Oppenheim Makes His Predictions

Oppenheim constructed his predictions around the static date October 1, 2020. Technically, the time spent waiting for a visa can change daily as petitions are adjudicated. Furthermore, the wait time depends on when the investor applied for the program. A more accurate description for the figure would be “the wait time for a hypothetical investor who entered the visa queue at this point in time” instead of “the estimated wait time.”

Another important point is that Oppenheim’s predictions are predicated on the “worst-case scenarios,” or those investors who are the very back of the line to receive their EB-5 investment visa. Consequently, most EB-5 investors from the referenced countries will have a shorter wait time than Oppenheim’s listed figures.

Oppenheim Makes His Predictions Based on Incomplete Data

Oppenheim’s analysis is problematic in that it does not account for all EB-5 applicants. His analysis includes only data from USCIS’s unadjudicated I-526 petitions and the National Visa’s Center unsettled, but qualified, applications. Importantly, this data does not include investors with pending I-485 petitions or investors who have attained I-526 approval but have some other delaying factor in their application. Consequently, Oppenheim’s prediction does not include data that would significantly alter his predicted wait times. One example is that roughly half of all EB-5 investors from India are currently living in the U.S. and are working on status adjustments. Groups like these are not included in Oppenheim’s analysis.

Given the issues with the exactness of Oppenheim’s analysis, the real question then becomes whether his EB-5 investment visa wait time figures are overestimates or underestimates.

Are Oppenheim’s EB5 Investment Wait Times Overestimates or Underestimates?

This is not a simple question to resolve. Returning to the equation for visa wait times (A ÷ B = C), any prediction for wait times (C) is dependent on how accurate the estimates for both A and B are. Those making predictions, including Oppenheim, are forced to make difficult decisions to determine how A and B should be calculated.

While whole careers could be made of running data with hypothetical scenarios to arrive at a prediction for the time it takes to process EB-5 visas, looking at the situations of individual EB-5 investors is significantly more useful. Here is a basic timeline for five steps in the EB-5 investment process with advice on how to limit the potential for delays in visa procurement.

What Are the Five Steps to the EB5 Investment Process?

Although individual investor situations can differ greatly, it often takes multiple years for someone to receive an EB-5 investment visa. This is what the process typically looks like.

Step 1: Submitting the I-526 Petition

An eligible investor can begin the EB-5 investment process at any time by filing an I-526 petition. When USCIS receives this petition, the investor is given a priority date.

Step 2: Waiting for the I-526 to Be Adjudicated and Approved

Visa availability greatly affects petition processing speed. Visa demand and supply often determine how long this process takes, although it can be several years. Investors from countries with remaining unclaimed visas can expect to be given precedence.

Step 3 for Investors Outside the U.S.: Consular Processing

The next step is for applicants living abroad is to complete visa processing through the National Visa Center once they have received I-526 approval. These applicants can receive EB-5 visas if they are available once they have officially applied for permanent residency and had a visa interview.

Step 3 for Investors Already in the U.S.: Presenting the I-485 Petition for Adjustment of Status

EB-5 investors who are already residing in the U.S. under a different visa program can apply for adjustment of status using a I-485 petition once EB-5 investment visas are available. The State Department’s monthly Visa Bulletin now becomes relevant. EB-5 investors whose countries are considered “current” in the bulletin are not likely to overrun the annual limit of roughly 700 visas. EB-5 investors from countries not considered “current” are more likely to experience delays, which may span several years.

Step 4: Submitting an I-829 Petition to Have Conditions on Residency Removed

The final step is for an EB-5 investor to submit an I-829 form during the final 90 days of their conditional residency period. If granted, this form removes the conditions on the investor’s residency, allowing them to stay in the U.S. permanently if they so desire.