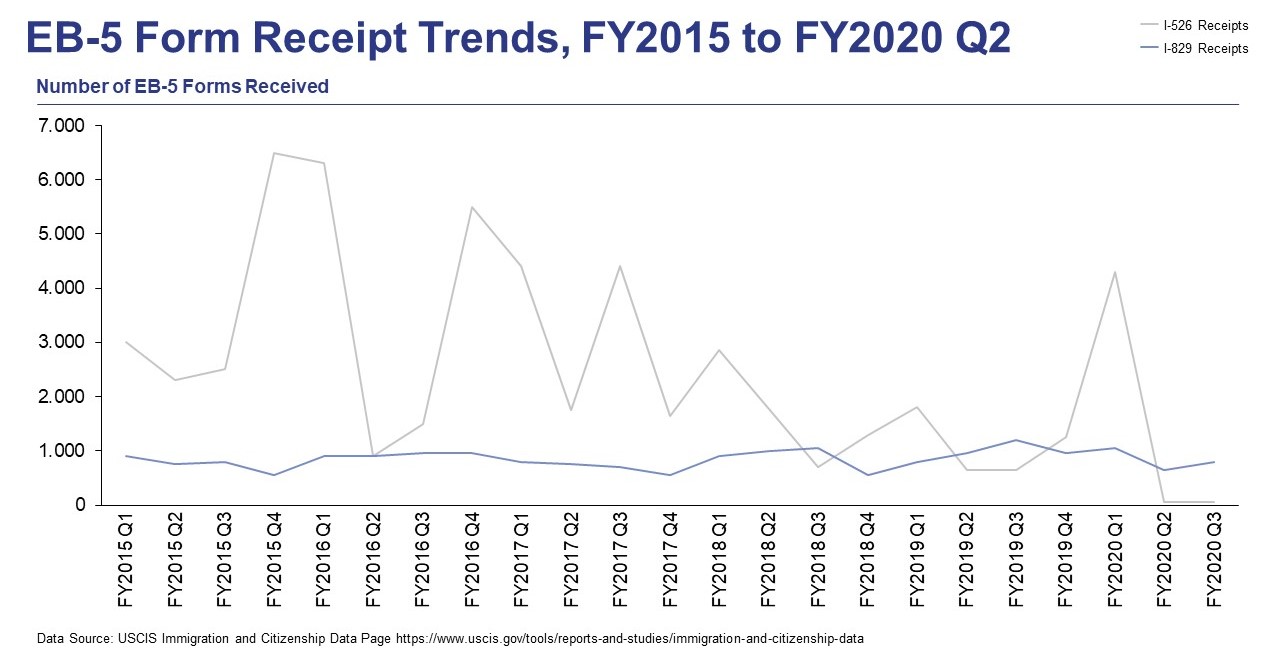

Throughout each year, United States Citizenship and Immigration Services (USCIS) publishes the processing data for each quarter of the fiscal year on its Immigration and Citizenship Data page. Although the data published is several months old, it can still help those in the EB-5 industry get a better understanding of what the actual numbers look like in terms of petitions being processed.

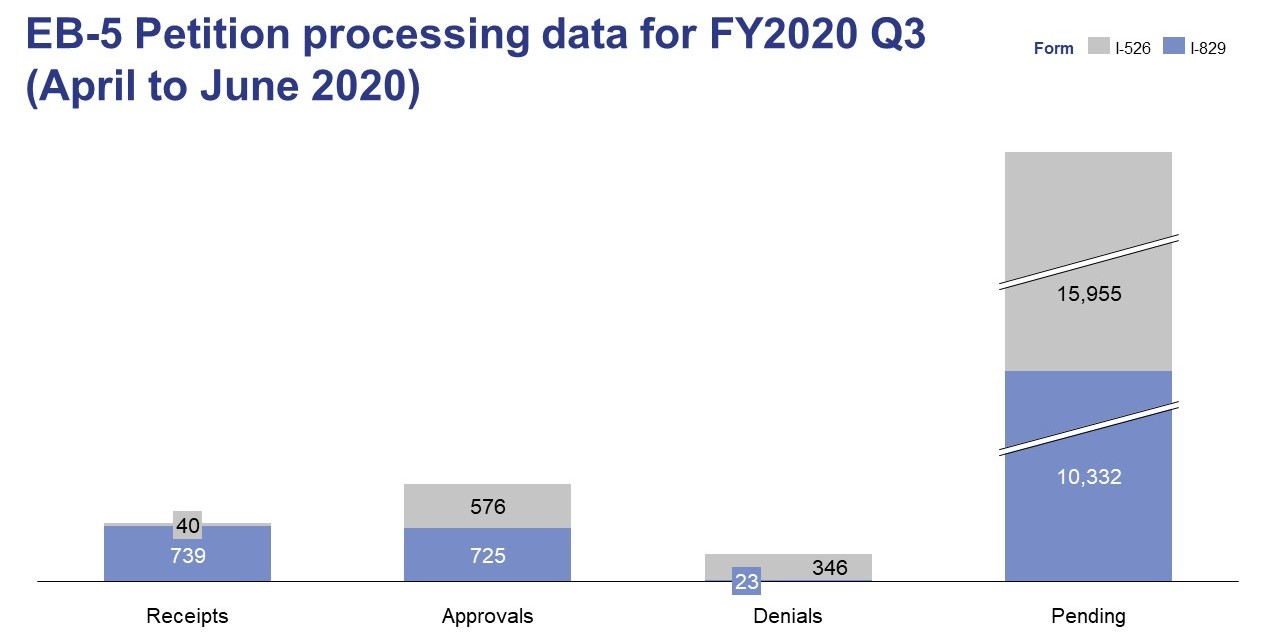

In November 2020, USCIS published the processing data from FY2020 Q3, which was from April to June 2020. This data, which includes all the different types of petitions USCIS processes, reveals some disheartening information for anyone involved with an EB-5 investment.

A Breakdown of EB-5 Petition Processing Data for FY2020 Q3

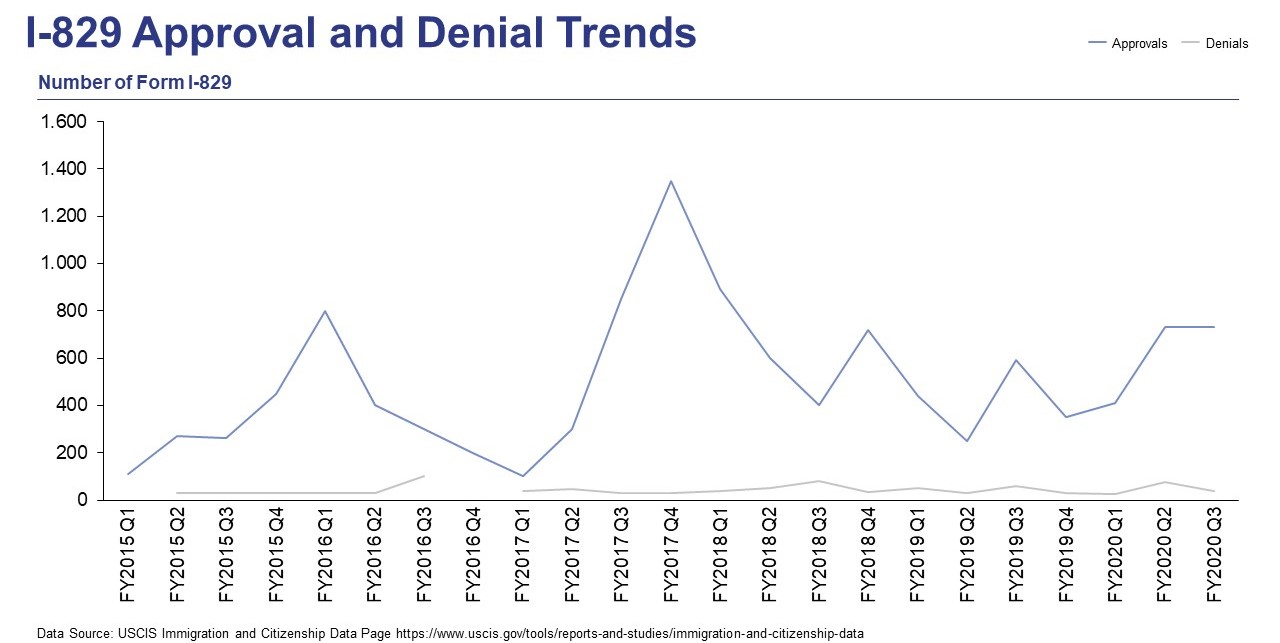

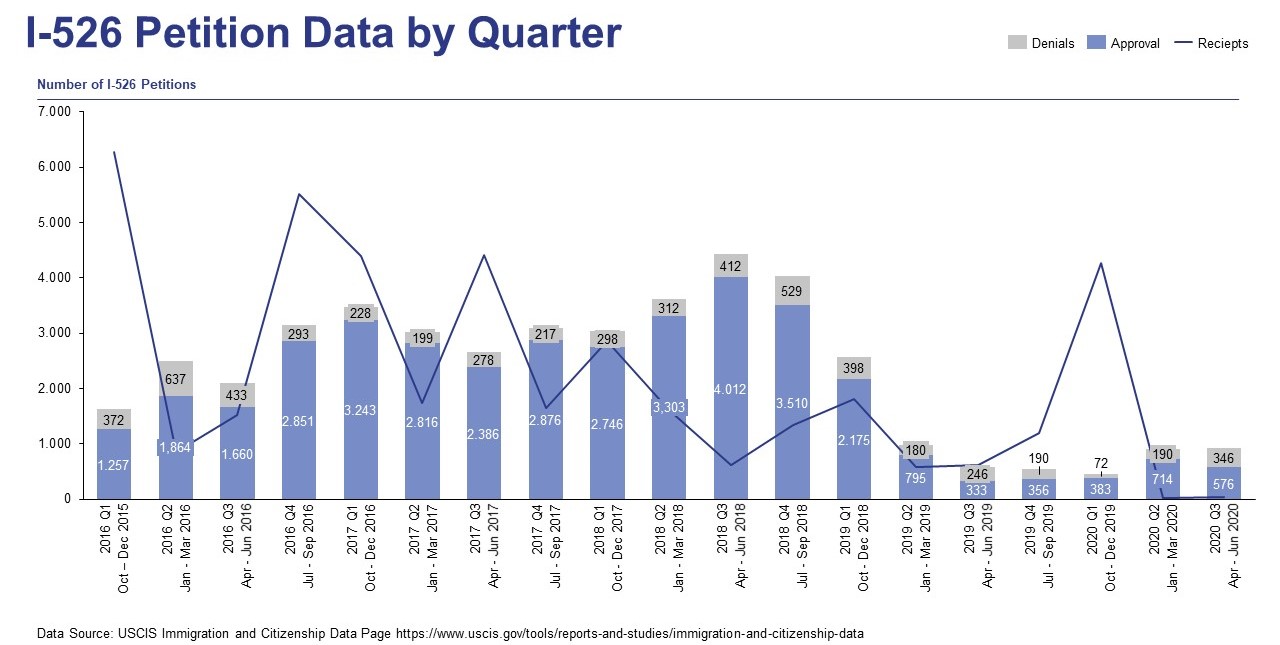

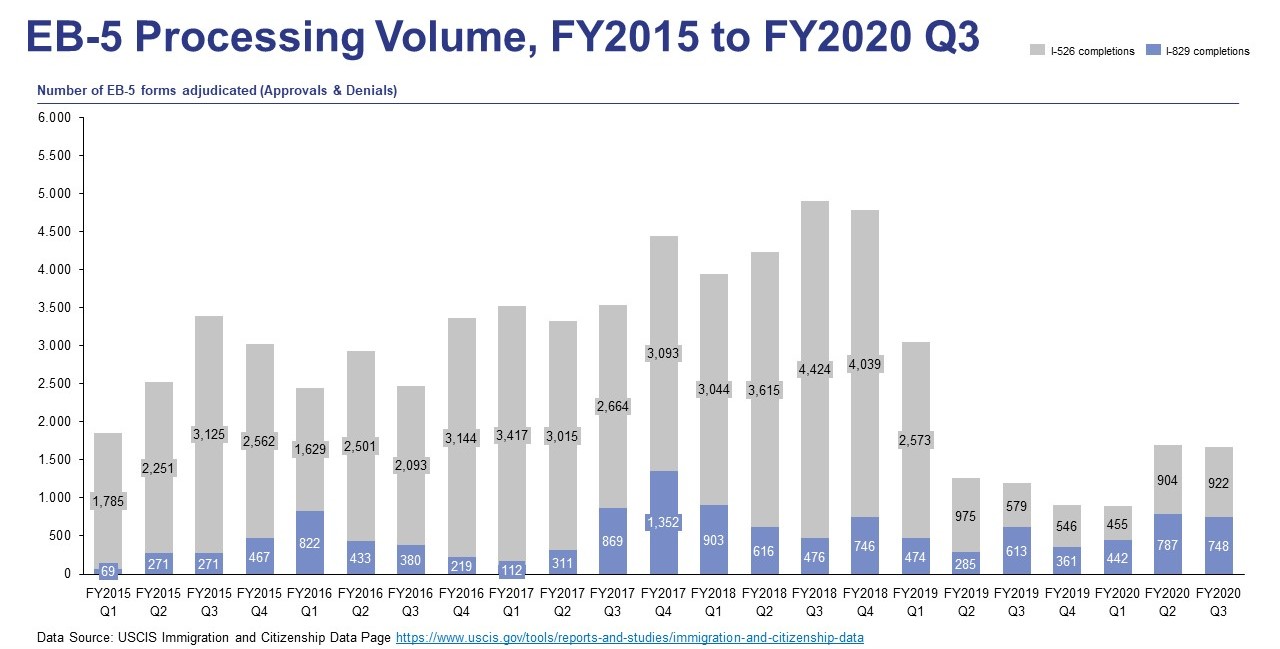

There are three major takeaways from the published data. The number of adjudications throughout FY2020 Q3 was extremely low, there was an unusually high number of I-526 petition denials, and adjudicating I-829 petitions was prioritized over adjudicating I-526 petitions. Only 922 I-526 petitions were adjudicated throughout Q3, and 37% of them were denied. And despite the much higher number of I-526 petitions pending, the number of adjudicated I-526 petitions is only slightly higher than the number of I-829 petitions.

Processing Data for I-526 Petitions

Receipts: 40

Approvals: 576

Denials: 346

Pending: 15,955

Processing Data for I-829 Petitions

Receipts: 739

Approvals: 725

Denials: 23

Pending: 10,332

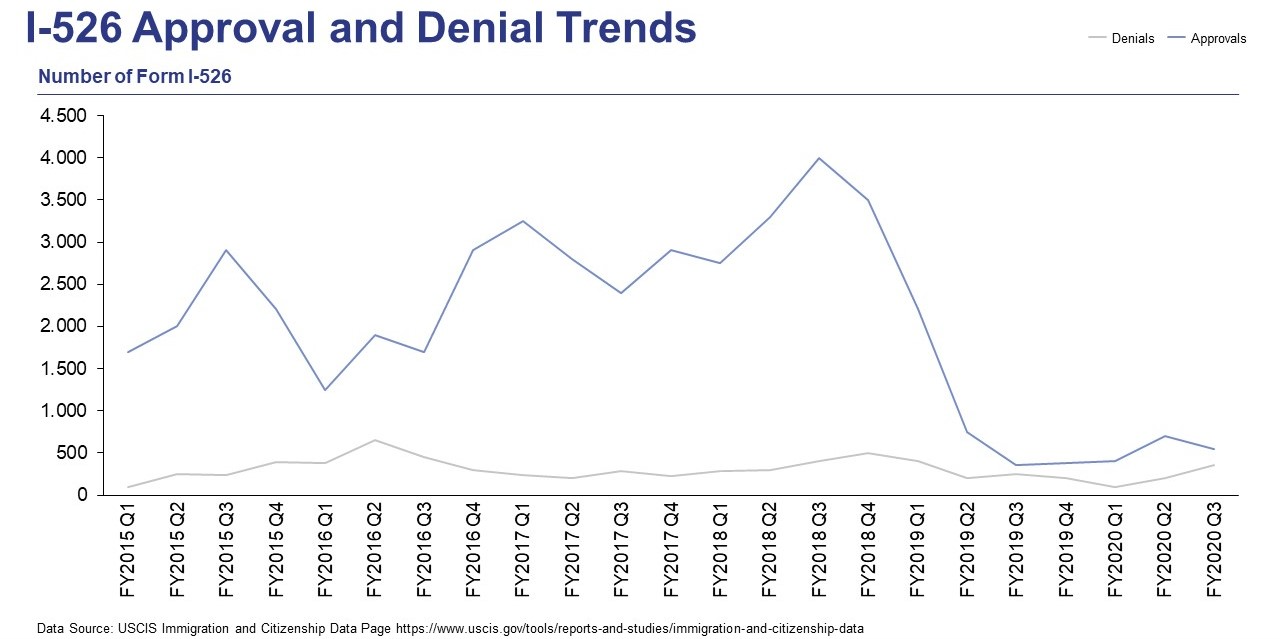

Sarah Kendall’s Impact on I-526 Petitions

Sarah Kendall has been leading as chief of the Immigrant Investor Program Office (IPO) since FY2019. Ever since the IPO was placed under her watch, processing volumes have dramatically decreased, but denial rates remained the same. Kendall states that the lower processing volumes and lower approval rates are strengthening the integrity of the EB-5 Immigrant Investor Program. It is possible that EB-5 petition processing volume will remain low as long as Kendall is chief.

A Decrease in I-526 Receipts

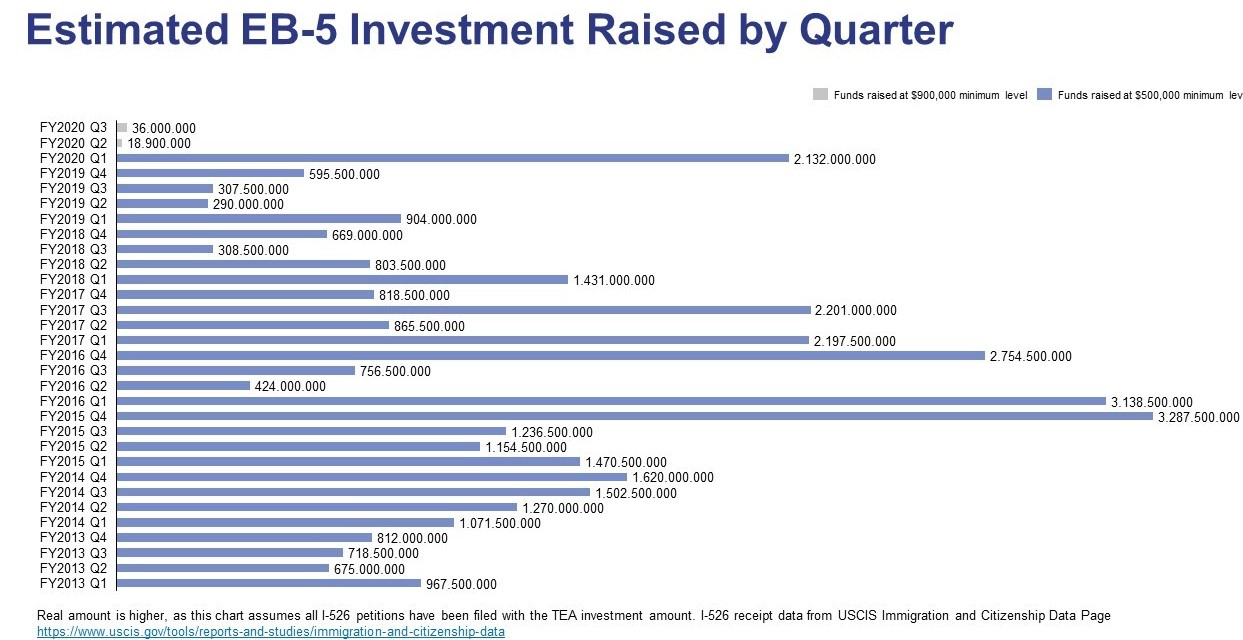

The new Modernization Rule took effect in November 2019, which increased the minimum EB5 investment amount from $1 million (or $500,000 for projects in a targeted employment area, or TEA) to $1.8 million (or $900,000 for TEA projects). This increase in investment amounts was an attempt to raise additional funds that would help cover the cost of USCIS’s operations.

However, this new requirement has had severe consequences for USCIS. Because EB-5 investments now require more capital, there has been significantly less interest in the program. For each quarter of FY2020, there was 45 times less EB-5 investment funds than in the previous six years. This low EB-5 demand resulted in less funds for USCIS, and it likely led to the agency’s financial crisis and narrowly avoided furlough.

This policy change is most likely why the data shows only 40 I-526 petition receipts in FY2020 Q3. The massive impact the COVID-19 pandemic had on U.S. immigration is another likely factor for the low number of I-526 receipts, as well as the high EB-5 demand from backlogged countries such as China and Vietnam.

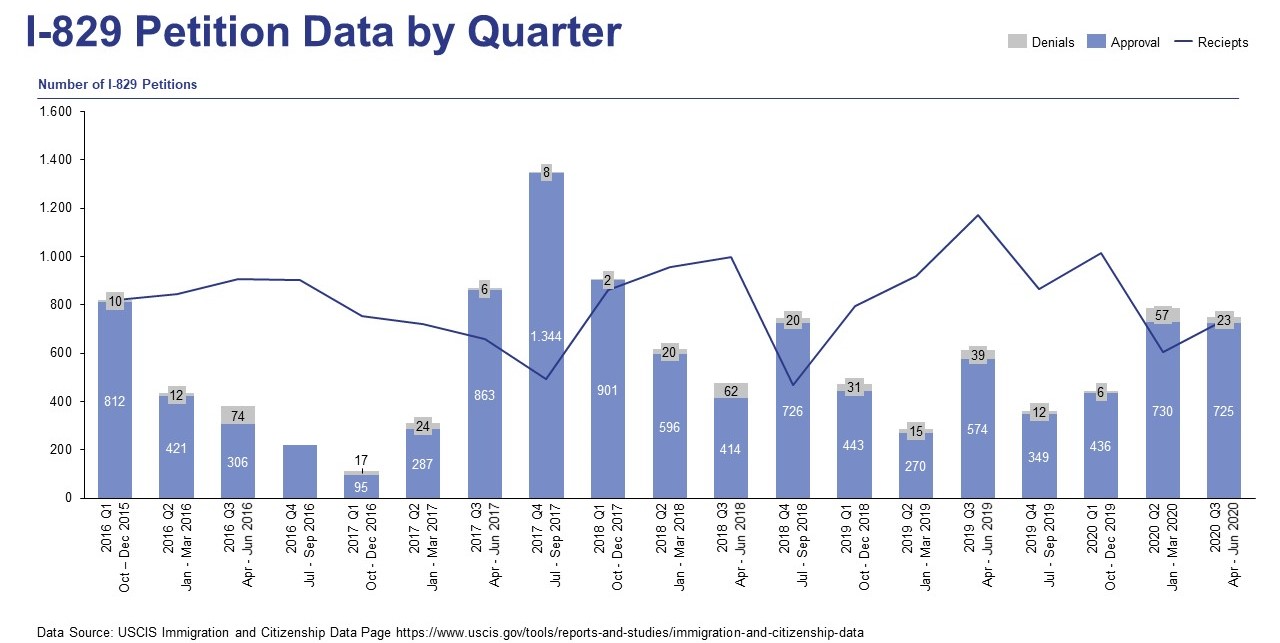

The Prioritization of I-829 Petitions

Despite the decrease in I-526 adjudication rates, I-829 adjudication rates have remained steady, and the rate of approval has not decreased like that of the I-526 petitions. There is a larger backlog of I-526 petitions, and yet the number of I-829 petitions adjudicated was almost equal to the number of adjudicated I-526 petitions. These figures clearly indicate that the IPO has shifted its focus to I-829 petitions.

How Low Processing Volumes Affect the EB-5 Program

The figures from FY2020 Q3 show that the EB-5 petition processing volume is unreasonably low. If USCIS’s processing remains at the rate indicated by the data, it would take 4.3 years to clear up the I-526 backlog and 3.5 years to clear the I-829 backlog up to June 2020. This would result in the EB-5 process taking seven times longer than intended when Congress created the program. However, it is likely that processing times will improve.

This low processing volume impacts the EB-5 program in several ways. Not only are investors experiencing unusually long wait times, but fewer EB-5 visas are also being claimed. For each fiscal year, about 10,000 visas are allotted to the EB-5 program. If the processing rate from FY2020 Q3 continues, only about 20% of the EB-5 visas will be claimed. At the end of the fiscal year, any unclaimed EB-5 visas are recycled into the EB-1 program. This will decrease the number of available EB-5 visas each year, slowly leading to the end of the EB-5 program.