While the EB-5 Immigrant Investor Program is popular amongst foreign nationals wishing to relocate to the United States, this visa-by-investment program is not without its risks. Two specific types of risk are recognized in the EB-5 investment industry: financial risk and immigration risk. Financial risk relates to the capital invested in the EB-5 project. United States Citizenship and Immigration Services (USCIS) requires EB-5 funds to remain at risk throughout the investment period. This means the investor might not get their original capital back at the end of the project.

Immigration risk, on the other hand, is the risk that, despite making an investment, the foreign national may not be granted permanent resident status. USCIS examines each investor’s visa petitions carefully to ensure all EB-5 regulations have been followed. In the event that USCIS adjudicators determine that the EB-5 investment or project is not compliant, they will deny the petition. If this happens, the foreign national will not be eligible for a U.S. green card.

Fortunately, the risks associated with an EB5 investment can be reduced through a process of due diligence. This involves a thorough evaluation of the EB-5 project. In this article, we outline six important factors that could influence a project’s immigration risk.

1. Adequate Funding

One source of immigration risk occurs if a project cannot be completed due to a lack of funding. This most commonly arises in projects that are over-reliant on EB-5 funds. If insufficient EB-5 investors subscribe to the project, the business may cease operating, and the investment will not qualify for the EB-5 visa program.

Prospective investors should carefully examine the financial data related to the EB-5 project. In particular, it is important that the project has other funding sources available, such as bank loans or equity.

2. Current TEA Status

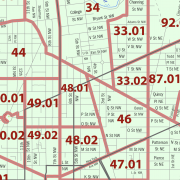

If a foreign national is looking to invest at the lowest investment threshold of $800,000, they need to choose a project located in a targeted employment area (TEA). These locations may be in rural areas or areas of high unemployment. In order for an EB-5 investment in a TEA project to qualify, the TEA Certification Letter must be valid at the time the investment is made.

Individual state agencies are responsible for issuing these letters for TEAs within their borders. If the TEA Certification Letter is not valid, the project will be considered a non-TEA project subject to a minimum EB5 investment of $1,050,000.

3. Employment Generation Plan

USCIS stipulates that each EB-5 investment should generate full-time employment for 10 U.S. workers. When evaluating potential EB-5 projects, a prospective investor should carefully examine the job creation plan to ensure a sufficient number of positions will be generated. If the business plans to hire exactly 10 workers for each EB-5 investment, the risk of one or more of these positions not being filled is high. This would put the investor’s U.S. green card in jeopardy.

If, on the other hand, the project plans to hire far more than 10 workers per investor, there is a lower risk of falling below the minimum level. The greater this job cushion, the lower the immigration risk.

4. Recruitment Schedule

In addition to the requirement that each EB5 investment must create 10 jobs for U.S. workers, there are criteria for when those employment positions can be created. The EB-5 investor can only count positions that start between the dates the investment is made and 2.5 years after USCIS approves the investor’s Form I-526. The exception is for jobs funded from other sources before any EB-5 capital was invested in the business, as these can also be included in the calculation.

Toward the end of the EB-5 visa process, the foreign national will have to prove to USCIS that the job creation requirement was fulfilled during that specific time period. This is part of the I-829 petition, which, if approved, will remove conditions on the investor’s permanent resident status, allowing them to remain in the United States permanently. Failure to comply with the EB-5 guidelines will result in the denial of this petition.

5. Exemplar Status

Project developers can request pre-approval for their EB-5 projects through a petition for “exemplar” status. This pre-approval confirms that the project fulfills USCIS requirements; it is therefore highly unlikely that USCIS adjudicators will deny the investor’s I-526 petition on the grounds of issues with the project.

Obtaining exemplar status can take 12-16 months, which means that projects that have filed their petitions may start accepting investors before pre-approval is granted. However, they should be able to provide evidence that the petition has been submitted.

In addition to pre-approved projects, EB-5 investors can be relatively confident about projects that have had I-526 petitions approved for previous investors. These projects have also demonstrated compliance with USCIS regulations, and future investor petitions are likely to be approved as well.

6. A Strong Business Plan

A prospective investor should examine the business plan of each EB-5 project as closely as they would any other investment. In addition to assessing the project’s potential for financial profit, it is important that the business plan demonstrates full compliance with EB-5 requirements. These are laid out in the Matter of Ho and include being able to keep the EB-5 funds at risk throughout the investment period and creating the required employment positions.

By evaluating business plans against USCIS requirements for EB-5 investment projects, investors can identify reliable EB-5 investment projects that carry a lower immigration risk.