The EB-5 Immigrant Investor Program, which was established in 1990, continues to provide one of the most stream-lined routes to gaining permanent resident status in the U.S. For this reason, it remains a popular option among foreign investors, granting thousands of U.S. green cards every year for the last three decades.

While this popular investment program was initially designed to create new U.S. jobs and thus stimulate the country’s economy through foreign capital, the incentives to foreign investors stretch beyond a simple return on investment. This program promises U.S. green cards for not only individual investors who meet participation requirements but also for their qualifying family members.

Program eligibility requirements include elements such as a minimum investment, proof of lawfully obtained funds, and U.S. job creation minimums. The initial step to deciding whether the EB-5 program is right for you is to determine whether investing in an EB-5 project makes sense in your circumstances. There are only two ways an EB-5 investor can inject capital into an EB-5 project: by directly investing in a qualifying project or by working with an approved regional center.

Direct Project Investment vs. Investing via Regional Center

First and foremost, understand that as long as an EB-5 investor meets all requirements, both investment paths lead to the same destination: U.S. green card(s) for qualifying investors and their families. It will be your personal and business preferences that dictate which route is best for you and yours.

EB-5 investors who specialize in management often prefer to have more control over their “at risk” investment and typically wind up opting for direct investment in an EB-5 project. Participating in the program this way leaves room for a greater level of active involvement and daily management of their new commercial enterprise (NCE).

On the other hand, if you seek minimal involvement in managing your selected EB-5 project, or if you would rather not be tied down to a specific location throughout the EB-5 process, you may prefer working with a regional center. In fact, most EB-5 investors choose this route for a number of reasons. Here are two big ones:

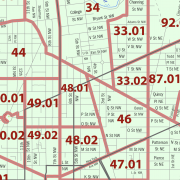

- Regional center-based projects have a greater likelihood of qualifying for targeted employment area (TEA) status (which reduces the minimum required investment amount by half).

- The job creation requirement is much easier to satisfy through regional centers since EB-5 investors can count indirect and induced jobs toward their totals.

So, what are the exact requirements for participating in the EB-5 program? Read on to learn more.

Capital and Jobs: Minimums for the EB-5 Program

Any foreign national with the fiscal means to invest in the EB-5 program may submit an application. The minimum amount required to invest is $1.8 million – unless an investor’s selected project lies within a TEA. Investors infusing capital into one of these targeted areas only need $900,000 to begin.

All qualifying EB-5 projects are considered for-profit commercial enterprises that conduct legal business activities. Part of qualifying for the EB-5 program is providing proof-of-funds documentation, which proves the lawful source(s) of your EB-5 capital investment. Funds from nearly any source may be deemed eligible as long as the investor presents a clear preponderance of evidence that they were sourced legally.

Then, in order to see a project through to securing a U.S. green card, each investor must document and submit evidence at the end of an investment period that describes how their capital produced a minimum of 10 new full-time employment positions for American citizens and residents.

Troubled businesses are sometimes another qualifying investment option. For these types of ventures, most requirements remain the same, but instead of just creating new jobs, sometimes saving at least 10 full-time jobs becomes an objective. Ultimately, in either case, it is not a deal-breaker for jobs to be lost throughout the process as long as the final tallies include enough new jobs to offset those losses. In other words, there cannot be fewer jobs available at the end of your investment period than at the beginning.

U.S. Green Card Eligibility for Program Participants

Often, EB-5 immigrant investors are seeking permanent residency in the United States for a spouse and children in addition to themselves. This is what makes the EB-5 program particularly appealing: Your spouse and unmarried children under the age of 21 may also submit petitions to obtain U.S. green cards under the same EB-5 investment.

Every EB-5 investor must initially file a Form I-526. Once approved, they can apply for a two-year conditional permanent residency for each person in their household who meets the above criteria. Within the last three months of conditional permanent resident status, the investor must file a Form I-829 to remove those conditions. If the investor can demonstrate that their investment has met all program requirements, unconditional permanent resident status is granted to all qualifying members under the investment.

A U.S. green card holds the key for EB-5 investors and their families to a new life full of advantages. Once you have been granted one, you can choose how you want to live, work, study, and travel within the United States. Five years after initially beginning the conditional permanent residency period, if an EB-5 investor or any of their eligible family members decide, they are even able to apply for U.S. citizenship.