The EB-5 Immigrant Investor Program was created by Congress in 1990 as a to way funnel foreign capital into the U.S. economy and create new jobs for U.S. workers. The program allows foreign nationals a unique opportunity to receive U.S. green cards for themselves and their eligible family members in exchange for an investment in an EB-5 project. However, making an EB-5 investment is not a simple process. EB-5 investors must meet a list of key requirements to be eligible for an EB-5 visa.

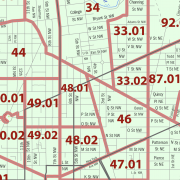

To begin the EB-5 process an applicant must invest a minimum of $1.8 million in a qualifying EB-5 project. If the project is located in a targeted employment area (TEA), the minimum required investment amount is reduced to $900,000. In addition to meeting the minimum investment amount, EB-5 investors must also satisfy the source-of-funds requirement. United Stated Citizenship and Immigration Services requires all EB-5 investors to be able to prove the legal sources for all of their investment capital. The agency states that investors must “demonstrate by a preponderance of the evidence that the capital invested, or actively in the process of being invested, in the new commercial enterprise was obtained through lawful means.” This rule exists to prevent investors from using illegally obtained money for an EB5 investment. While this rule does help the integrity of the EB-5 program, it can be difficult for investors to gather all of the necessary documentation to satisfy such a requirement.

Required Documentation is Unique to Each Investor

Unfortunately, there is no one-size-fits-all approach to fulfill this requirement. Because each EB-5 investment is unique, each investor will have to supply the documentation needed for their specific situation. Furthermore, if an investor’s documents are not in English, they are required to submit certified translations in English along with their documents.

An investor’s EB-5 investment capital can come from multiple sources, as long as all of it can be traced back to legal sources. Because of this, many different documents are often needed to prove the legality of the multiple sources of the investment capital. Potential source documents include the following:

- Employer pay statements

- Bank statements

- Loan documentation

- Investment records

- Tax returns

- Sale of asset records

- Documentation of business revenue

- Letters detailing gifts

How Early Should an Investor Prepare?

Accurately estimating the amount of time it takes to gather the necessary documents depends on how many sources an investor’s capital is derived from and how easily available documentation is. An experienced immigration attorney can help EB-5 investors make sure that they use the best funds for their EB5 investment capital so that they can easily prove the lawful sources.

Anyone planning an EB-5 investment should begin gathering the necessary documentation for the source-of-funds requirement long before they intend to make their investment. The earlier they prepare for this requirement, the easier it will be to complete their I-526 petition and avoid any potential delays in the filing process.

Submitting Documents with Your I-526 Petition

You can never be too careful when it comes to providing USCIS with the right documents. If you are unsure if a document is necessary, it is best to include it anyway, as you will not be punished for including excessive documents. The more evidence you provide to prove the legality of your capital, the better the chance that the adjudicator will approve your petition without a request for evidence (RFE).

The necessary documentation may not be available. Many banks delete records and bank account statements after a certain period. When something like this happens, you can have your accountant provide a sworn affidavit that details the information that would otherwise be included on the bank statement. The affidavit should also detail why the original document is not available. When these circumstances arise, there is usually an acceptable way to provide supplementary documentation that is acceptable to USCIS. This allows you to overcome these obstacles and still have a successful EB5 investment.